STUART MACHIN, CHIEF EXECUTIVE

“The first half of this year was an extraordinary moment in time for M&S. However, the underlying strength of our business and robust financial foundations gave us the resilience to face into the challenge and deal with it. We are now getting back on track.

Change, on the other hand, is not a moment. Change is constant and that is why we are resolute in our ambition to reshape M&S for growth. During the half we accelerated our transformation with investment in our priority areas; opening 15 new or renewed stores in H1 and planning more than 20 for H2, strengthening our technology foundations, and confirming our new automated Food distribution centre - critical to modernising our supply chain and getting ahead of growth.

Today, we are regaining momentum. In Food we continue to outperform the market, with three years of consecutive monthly volume growth. Our obsession with quality and innovation is paying off, underpinned by a relentless focus on trusted value, with value ranges growing year-on-year. In Fashion, Home & Beauty, the recovery curve has been slower than Food, but we are making progress every day. Our stronger style credentials mean our fashion is resonating and we continue to lead the market on quality and value. We are determined to help our customers have a fantastic Christmas with exceptional service and what I truly believe is the best Christmas food and fashion in the market.

Thank you to our colleagues for their hard work, our suppliers for their support and our customers for their loyalty. We are grateful to everyone who shops with us, and if you haven’t yet, please do.

In the second half, we expect profit to be at least in line with last year. This should give us a springboard into the new financial year and set M&S up for further growth. The retail sector is facing significant headwinds – in the first half, cost increases from new taxes were over £50m - but there is much within our control and accelerating our cost reduction programme will help to mitigate this. Our plan to reshape M&S for long-term sustainable growth is unchanged, our ambitions are undimmed, and our determination to knuckle down and deliver is stronger than ever.

To date we have achieved meaningful progress, but what’s exciting is that there is so much more to do and so much opportunity ahead of us.

It’s all to play for”

..........................................................................................................

First half result reflects cyber incident impact and cost of recovery

- M&S Group adjusted PBT1 £184.1m (2024/25 £413.1m), reflecting one-off impact of the cyber incident

- Insurance income proceeds of £100.0m, in respect of the incident, recorded centrally in adjusted profit

- Food sales2 up 7.8%; adjusted operating profit of £89.1m (margin of 2.0%)

- Fashion, Home & Beauty sales down 16.4%; adjusted operating profit of £46.1m (margin of 2.7%)

- International sales down 11.6%; adjusted operating profit of £13.3m (margin of 5.2%)3

- Ocado Retail operating loss before adjusting items of £3.1m4

- Adjusting items of £167.8m includes £101.6m of incident related costs

- Interim dividend increased in line with policy to 1.2p from 1.0p

- Strong balance sheet; net funds excl. lease liabilities of £176.1m and cash and liquidity of over £1.6bn

Further progress and investment in Reshaping for Growth

- Food value and volume outperformance for 37 months, driven by improved perceptions of value and quality

- Fashion, Home & Beauty style perceptions further improved

- International reset to deliver growth in franchise. New wholesale and marketplace agreements launched

- Ocado Retail driving value and volume share. M&S Food outperforms total sales growth on Ocado.com

- £340m investment announced in Food supply chain, securing capacity for future growth

- 18 new stores planned to open by the end of the financial year. Six of these opened in H1

- Cost reduction ambition increased to £600m, helping mitigate inflation, national insurance and other regulatory cost increases

- Increased investment in growth, despite incident costs, through disciplined capital allocation

| Group Results (26 weeks ended) | 27 Sep 2025 | 28 Sep 2024 | Change (%) |

| Sales | £7,965.2m | £6,524.3m | 22.1% |

| Operating profit before adjusting items | £251.4m | £462.7m | (45.7%) |

|

M&S Group adjusted profit before tax1

|

£184.1m | £413.1m | (55.4%) |

| Adjusting items | (£167.8m) | (£15.9m) | n/a |

| Adjusted basic earnings per share | 6.6p | 14.7p | (55.1%) |

| Dividend per share | 1.2p | 1.0p | 20.0% |

| Adjusted return on capital employed | 12.4% | 15.0% | (2.6%) pts |

| Free cash flow from operations5 | (£193.0m) | £21.1m | n/a |

| Net debt6 | (£2.53bn) | (£2.16bn) | (16.7%) |

| Net funds excluding lease liabilities6 | £176.1m | £22.4m | n/a |

| Statutory Results (26 weeks ended) | 27 Sep 2025 | 28 Sep 2024 | Change (%) |

| Revenue | £7,942.3m | £6,481.0m | 22.5% |

| Statutory profit before tax7 | £3.4m | £391.9m | (99.1%) |

| Attributable profit after tax | £6.2m | £282.1m | (97.8%) |

| Basic earnings per share | 0.3p | 14.0p | (97.9%) |

1 M&S Group adjusted profit before tax excludes the profit attributable to shares we do not own in subsidiary companies and adjusting items. See page 12 for a bridge between this measure and statutory profit.

2 References to ‘sales’ throughout this announcement are statutory revenue plus the gross value of consignment sales ex. VAT.

3 Results of the Channel Islands have been reclassified from International to be reported within either Food or Fashion, Home & Beauty.

4 Results reflect the first-time consolidation of Ocado Retail Limited, with the prior year including M&S’ group share of result in Ocado Retail Limited.

5 Lease surrender payments have been split out from cash lease payments and are now within free cash flow but no longer within free cash flow from operations.

6 Net debt now includes the M&S Travel Money Revolving Credit Facility agreement with Eurochange.

7 Statutory profit before tax includes losses attributable to non-controlling interests of £18.0m (2024/25 £3.5m), driven by consolidation of Ocado Retail Limited.

Non-GAAP measures and alternative performance measures (APMs) are discussed within this release. A glossary and reconciliation to statutory measures is provided at the end of this document. Adjusted results are consistent with how business performance is measured internally and presented to aid comparison. Refer to Notes 1 and 3 of the financial information for further details.

M&S REGAINING MOMENTUM

The past six months have been an extraordinary period for M&S and the one-off effects of the incident are reflected in our first half results. Despite the substantial disruption, we made further progress and increased investment in our transformation, investing in new stores, launching the long-term modernisation of our Food and Fashion supply chains, and strengthening our technology infrastructure. These actions are reshaping M&S for restored momentum in the second half of the year and beyond.

Profit performance for the half year was heavily distorted by the one-off impact of the incident and related recovery costs. M&S Group adjusted profit before tax of £184.1m declined by £229.0m versus the prior year, driven by lower online sales and increased stock management costs in Fashion, Home & Beauty and higher markdown and waste in Food. This was partially offset by insurance proceeds relating to the incident which are recorded in insurance income rather than divisional profits. The result was also impacted by significant new cost increases of over £50m for the new Extended Producer Responsibility packaging levy and higher national insurance contributions.

The Food business is now largely recovered and is showing strong sales performance and margins are closer to normal. As we have rebuilt online customer traffic in Fashion, Home & Beauty, recovery has been slower, as systems complexity means it has taken time to smooth the flow of stock. As indicated in May, the statutory profit before tax of £3.4m in the period includes costs in adjusting items related to the incident, reflecting the necessary and temporary use of onshore resources to restore systems and infrastructure, which are being stood down.

Food sales rose by 7.8%. Customer numbers and market share continued to grow as we delivered a consistent rhythm of innovation and quality upgrades. Operating profit of £89.1m reflects a margin decline to 2.0% from 5.1%, largely due to the higher level of markdown and waste caused by manual stock allocation, as we protected customer availability and suppliers. With systems now restored, markdown and waste have reduced, and operational metrics and gross margins are closer to normal.

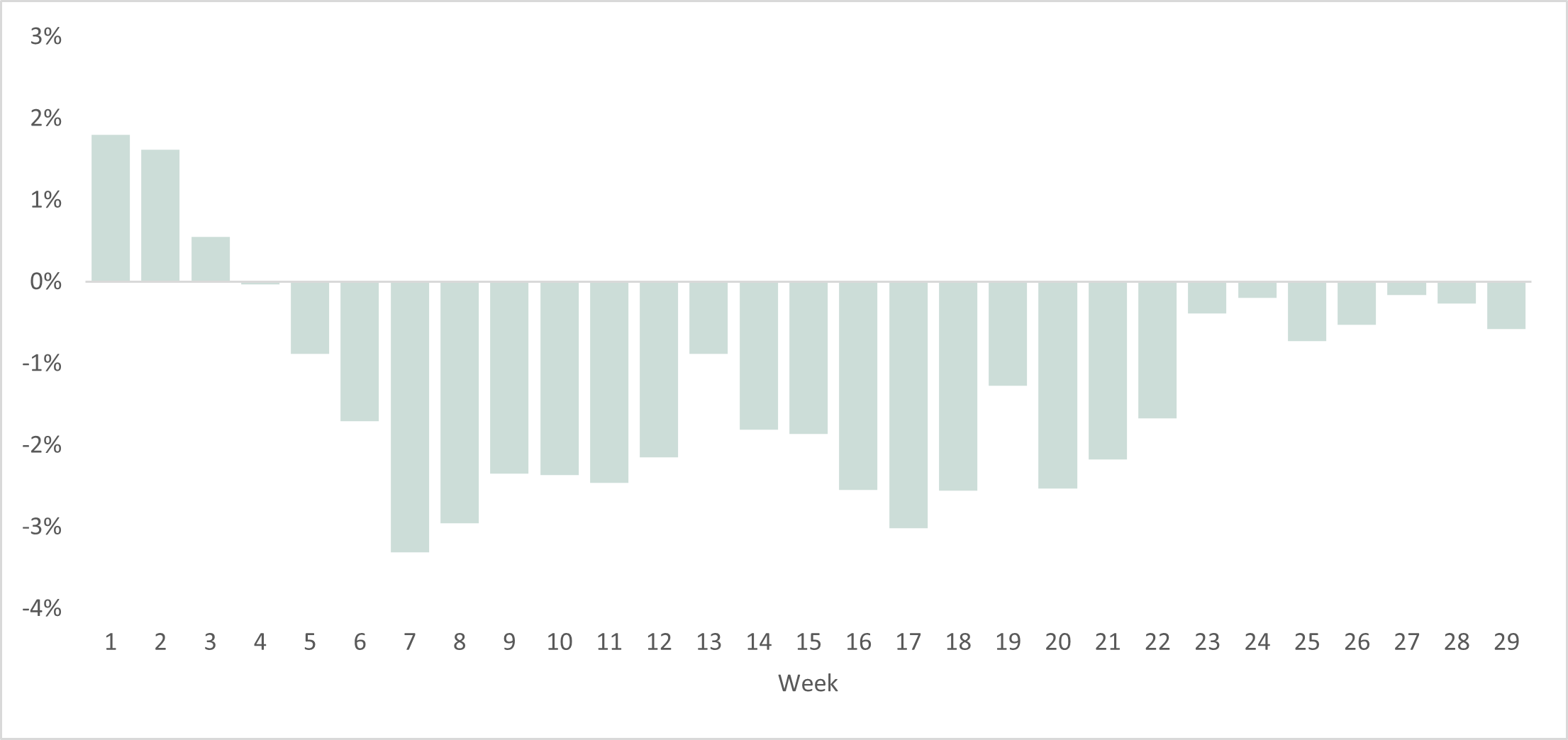

FOOD: CHANGE IN RECORDED GROSS WASTE1 VS. LAST YEAR AS A PERCENT OF SALES

1UK Gross waste excluding stock loss and closing balance sheet adjustments

Fashion, Home & Beauty sales declined by 16.4%, due to the temporary pause in online operations from late April to early June and a gradual recovery over the summer. Home delivery resumed first, followed by click and collect in early August. Store sales were impacted by reduced availability and fewer visits linked to the absence of click and collect. Lower sales and higher stock management costs led to an operating profit of £46.1m and a margin decline to 2.7% from 12.0%. With warehouse systems now restored, both our website and stores are improving availability, and trading is recovering.

FASHION, HOME & BEAUTY: ONLINE SALES GROWTH1

1 Sales inclusive of VAT pre-returns

Our other businesses have also shown resilience. International has made progress restructuring franchise agreements and launching new wholesale partnerships, developing the M&S brand in new channels. The Ocado Retail JV has continued to deliver double-digit sales growth, led by strong demand for M&S Food, where it is offering a broader range than ever before. Improving the throughput of existing customer fulfilment centre (CFC) capacity will support further growth and the path towards generating operating profits.

The first half closed with a net funds position (excluding leases), despite the combined impact of reduced profit, incident-related costs and working capital outflows. We anticipate working capital balances will partially reverse in the second half. M&S continues to maintain a strong investment-grade balance sheet.

OUTLOOK

As we enter the second half, the consumer environment remains as uncertain as ever. Our priority remains to offer the best value, quality, innovation and style to customers, to drive the transformation and to structurally reduce costs as external headwinds continue to increase.

We are confident we will be recovered and back on track by the financial year-end. In the second half we therefore anticipate profit at least in line with last year, as the residual effects of the incident continue to reduce in the coming months.

Our medium and long-term ambitions are unchanged. We will achieve these through disciplined capital allocation, focused execution and sustained investment to Reshape M&S for Growth.

RESHAPING M&S FOR GROWTH

We entered 2025/26 with strong trading momentum and a clear plan to invest in transformation and growth. However, in the first few weeks of the financial year, we experienced a cyber incident. We responded quickly and took immediate action to protect our customers, our suppliers and the business which included proactively taking some of our systems offline. Since the incident, we have prioritised recovery across our technology estate and restoring operations. Our customer-facing systems were restored in the summer, and practically all operational systems have now been recovered. We continue to strengthen their resilience and will seek to increase the pace of transformation in the coming year. These actions will help create simpler technology architecture and support the store, online and logistics investments which underpin future growth in Food and in Fashion, Home & Beauty.

Incident recovery at advanced stages

Our response to the attack required the disconnection of warehouse management systems leading to the pausing of online orders, click and collect and in-store ordering. Manual processes were swiftly introduced to maintain trading and ensure continuity in forecasting, ordering and replenishment. Customers were able to shop in our stores throughout.

We formed a strong business recovery team led by Sacha Berendji, our Operations Director, and operational restoration has been the primary focus of the technology team during the period. We are now at the advanced stages of this process. The restoration of critical trading and customer-facing systems was prioritised and our online offer was restored in August. Following the temporary removal of system access to third-party providers, specialist onshore teams supported remediation.

The objective of the technology transformation is to modernise and simplify the estate and evolve the organisation to serve the business better. While the necessary recovery activity in the first half has delayed implementation of some of these changes, we expect transformation to pick up pace next year.

For the remainder of the year, our focus will be ensuring operational resilience, cost control and building new applications that support growth. Delivery timelines for the new Fashion, Home & Beauty planning platform have been fast tracked, and we are investing in capabilities including personalisation and loyalty. This includes the relaunch of Sparks next year to support customer engagement and drive broader and more frequent shopping visits.

Investing for growth: Stores and formats

Our goal is to grow to 420 Food stores and to create a more focused, productive full line estate of around 180 stores, as online grows towards 50% of Fashion, Home & Beauty sales.

In Food, momentum is building. During the period, we announced investment in a number of former Homebase sites which average over 18,000 sq. ft. We currently anticipate 14 new Food store openings this financial year. More than 50 Food stores are currently approved for opening, alongside a number of extensions.

In Full line stores, two new flagship locations and one extension will open in H2. 15 new full line stores and four extensions are also approved for opening in future years. Relocations and extensions have generated strong returns and remain a priority, while closures of legacy locations will increase in the coming months.

Investing for efficiency: Logistics and cost to serve

Our objective is to create a streamlined, automated logistics network that increases capacity, reduces complexity and structurally lowers cost to serve.

We announced a £340m investment in a new 1.3m sq. ft national distribution centre for our Food business at Daventry, incorporating proven automation. Opening in 2029, the site will create additional capacity with a structural reduction in cost per case. A new regional depot opens in Bristol in 2026, increasing the proportion of stores served from their nearest depot.

There is a similar opportunity to improve customer experience and reduce cost in the Fashion, Home & Beauty network. We are increasing capacity in our most efficient automated distribution centres, reducing inter-network moves and split shipments that currently elevate fulfilment costs and impact customer experience.

During the first half of next year, click and collect sortation at Castle Donington will go live, improving next-day delivery cut-offs. This will be accompanied by additional automated boxed storage at Castle Donington and Bradford, increasing capacity by over 30%. These are phase one investments in a multi-year plan to transform the customer proposition and drive our cost to serve to more competitive levels.

FOOD: GROWING SHOPPERS, DRIVING VOLUME AND DELIVERING MARKET SHARE

Our overall ambition for Food is to grow market share by 1% between 2022/23 and 2027/28 and deliver an on-going operating margin over 4%. Given our low overall market share and the opportunity to drive frequency of shop and larger baskets, we believe there is potential to double sales over the long-term by becoming a ‘shopping list retailer’, with new and renewal stores driving growth, supported by a modern, cost competitive supply chain.

Sales increased by 7.8% with UK volume growth of 2.8%, reflecting a consistent programme of new product launches, investment in trusted value and focus on protecting customer availability and suppliers. Market share increased by 10 bps in the 12 weeks to 5 October 2025, with growth accelerating towards the end of the period as volume benefited from an improving proposition and the restoration of click and collect. Customer numbers, frequency, and perceptions of quality and value relative to the market continued to increase.

Operating profit of £89.1m reflects a margin decline to 2.0% from 5.1%, largely due to higher markdown, waste and stock loss caused by temporary manual stock allocation. With systems now restored, these have reduced, and operational metrics have improved.

Consistent range development and innovation

- Over 700 new products were launched in the first half, including in Food on the Move and Deli. Quality upgrades were made in Italian meals, salads and sushi, as part of our 1,000-line annual programme. Sales from new product development grew 19%.

- Investment in trusted value drove overall sales growth of 29% in Remarksable Value, ‘Dropped & Locked’ and ‘Bigger Pack, Better Value’ lines. Top performers included 12 packs of eggs, chestnut mushrooms and in-store bakery baguettes.

- Viral product successes included the Red Diamond Strawberry & Creme Sandwich, Chunked N’ Loaded Cookies and air fried chicken tenders.

New and renewal stores driving growth

- New and extended stores opened in Swindon, Orpington, Cheltenham, Leytonstone and Heathrow T5, our first airside store. The pipeline of new openings is gaining momentum.

- Foodhall renewals opened in Pantheon (Oxford Street), Brent Cross, Merry Hill, Brooklands and Pudsey. The twelve renewals opened over the past year have delivered sales uplifts to date of c.16%.

Progress in building a modern, cost-efficient flow of product

- Long-term agreements are being signed with strategic partners, securing supply and investment in upgrading capabilities in categories such as Italian meals.

- The forecasting, ordering and allocation system rollout completed in 2024/25, with potential to optimise freshness and shelf life further, to above pre-incident levels.

- Construction is on track for the opening of new depots in Bristol and Daventry, which will increase capacity and lower cost to serve.

- Operational processes and routines have been reset, building on the ‘M&S Way’ programme to deliver improved availability and streamlined stock.

FASHION, HOME & BEAUTY: INCREASING STYLE, INVESTING IN GROWTH, MOVING WITH THE TIMES

Fashion, Home & Beauty aims to grow market share by at least 1% between 2022/23 and 2027/28 and deliver an on-going operating margin over 10%. Given our large online customer base, we believe there is long-term potential to double sales online, through modernising fulfilment, sourcing, buying and stock flow, and increasing operational efficiency.

Sales declined by 16.4%, primarily due to the pause in online from late April to early June. The restoration of the online offer was phased, with home delivery resuming in June and click and collect restored in August.

- Store sales declined 3.4% due to reduced availability and fewer visits linked to the lack of click and collect.

- Online sales declined 42.9%, although following recovery, sales run-rates have been improving.

Operating profit of £46.1m reflects a margin decline to 2.7% from 12.0%, driven by lower sales and stock management costs. With warehouse and replenishment systems now restored, both the website and stores are improving availability and operations are recovering.

Further improvements to style demonstrated by product highlights

- Womenswear sales were led by knitwear, trousers and accessories. A strong response in stores to the Autumn campaign drove good growth in jeans and outperformance in jackets.

- Lingerie outperformed with an expanded range of £10 bras driving sales growth from younger customers.

- Menswear saw success in casual categories, and recent momentum in smart outfits including the Autograph performance range.

- Kids lagged the market. As we invest in value, daywear prices have been reduced by more than 20%.

- Home & Beauty grew in store sales in bedding and own label fragrance. Launches included Kelly Hoppen in Home and Estée Lauder in Beauty, demonstrating the potential.

New store performance providing foundations to accelerate change

- Last year’s store openings delivered sales growth above plan. Two new full line stores will open in Bath and Bristol Cabot Circus in the second half.

- The Fashion, Home & Beauty renewal at Pantheon (Oxford Street) is underway ahead of the expected redevelopment of Marble Arch. Renewals will also open at Brent Cross, Merry Hill and Douglas later this financial year.

Focus on driving online growth and end to end supply chain transformation

There is a substantial opportunity to grow online, through category focus and improved efficiency, stock flow and customer proposition in the end-to-end supply chain. Change is accelerating under the leadership of John Lyttle. This includes:

- Cutting slow-moving lines, enabling M&S to standardise and leverage volume with strategic suppliers to invest in quality and value.

- Upgrading the website experience and implementing new merchandising capability, including accelerating delivery of the new planning platform.

- Improving customer proposition. Click and collect sortation will open next year at Castle Donington, enabling later delivery cut-offs for online orders.

- Expanding lower cost capacity, with more boxed automation reducing the need for more expensive customer fulfilment routes.

- Reducing retail costs, through better operational routines, ensuring product preparation in the lowest cost part of the supply chain.

INTERNATIONAL: EARLY PROGRESS ON COMMERCIAL RESET

Although International sales declined in the first half, we are increasingly confident of our long-term vision of focused growth of the M&S brand globally. We aim to achieve this by using the expertise and infrastructure of strategic franchise partners in established markets, working with leading marketplaces to drive online growth, and securing new opportunities in wholesale.

Sales declined 11.6%, 10.0% at constant currency, with an improving trend in Q2. Operating profit before adjusting items was £13.3m (2024/25: £10.7m), with the decline in sales offset by reduced costs and new wholesale business.

- Franchise sales were down 9%, reflecting shipment disruption due to the incident and prior year comparatives. Sales in Q2 grew by 17%.

- Owned business sales declined 17%, reflecting similar effects to the UK business as replenishment was impacted by the incident, stock flow from suppliers and the temporary suspension of M&S directly operated websites. This decline moderated to 12% in Q2.

Despite disruption there was strategic progress on asset light development in the first half.

- Commercial terms were reset with several franchise partners, enabling investment in trusted value in the coming year.

- Marketplace agreements were expanded with Amazon and Zalando in Europe, leveraging their capabilities to improve customer reach and reduce fulfilment costs.

- New wholesale arrangements were agreed in markets without an M&S store presence. This included launching Fashion in David Jones, Australia, with additional agreements planned for launch in H2.

OCADO RETAIL: REDUCED LOSSES, OPTIMISING GROWTH

Ocado Retail combines M&S Food with Ocado Group’s automated fulfilment to offer differentiated online choice, service and customer experience. It aims to be the most trusted online grocer, improving online experience and increasing efficiency to deliver improved operating margins.

From 2025/26, Ocado Retail Limited’s results are consolidated by M&S and aligned with M&S’s year-end accounting period. Results for the current period therefore relate to the 25-weeks ended 28 September 2025, and reflect revenue of £1,479.9m and an adjusted operating loss of £3.1m. The joint venture was accounted for via the equity method in the prior period.

To aid future comparison, all commentary below relates to the 26-weeks ended 28 September 2025.

Revenue increased by 14.9% to £1.5bn, with orders up 12.0% driven by growth in active customers due to more effective marketing, improved retention and increased frequency. Average selling price grew by less than UK grocery inflation, as Ocado Retail continued to invest in value. M&S sales on Ocado.com increased by 19.6% and accounted for 29.3% of total Ocado Retail sales. Within the half the business migrated its e-commerce operations across web and app to the Ocado Smart Platform.

CFC efficiency improved, although gains were partly offset by higher service delivery and fleet maintenance costs. As a result of sales growth, increased gross margin and operational improvements, operating loss before adjusting items decreased from £12.5m to £3.6m.

Ocado Retail sees substantial opportunity to drive sales by improving availability and choice and increasing convenience. The path to profitability critically depends on improving CFC throughput, creating additional capacity for growth, with low capital spend.

Key opportunities include:

- Improving delivery efficiency, including more same day slots available on Ocado.com, enabled by the move to Ocado Smart Platform.

- Extending picking hours and rolling out further automation to maximise use of existing CFCs.

STRONG BALANCE SHEET AND CASH FLOW POSITION

We closed FY25 with an investment grade balance sheet, strong credit metrics and net funds excluding lease liabilities of £447.6m. This position has enabled us to absorb temporary costs of the incident while increasing investment in transformation and future growth. Looking ahead, we anticipate annual capital expenditure of between £650-750m, net of disposals, in the coming financial year.

During the first half of the year, free cash flow from operations saw an outflow of £193.0m driven by reduced profit, incident related costs and a working capital outflow. Despite this, we had net funds excluding lease liabilities of £176.1m at the half year.

We are declaring an interim dividend of 1.2 pence per share in line with our policy of the interim dividend being one third of the prior year total, an increase of 20%. A strong balance sheet, cash flow performance and dividend cover allow for further growth in the medium-term.

For further information, please contact:

Investor Relations

Fraser Ramzan: +44 (0) 7554 227 758

Helen Lee: +44 (0) 7880 294 990

Media Enquiries:

Corporate Press Office: +44 (0) 20 8718 1919

Investor & Analyst presentation and Q&A:

A pre-recorded investor and analyst presentation will be available on the Marks and Spencer Group plc website here from 7:30am on 5 November 2025

Stuart Machin and Alison Dolan will host a Q&A session at 9:30am on 5 November 2025.

For the quickest joining experience, please register prior to attending the call here. After registering, you will be given unique dial in details to join the call.

Alternatively, you can use the below details to join the call but please join 5-10 minutes before the start time in order to register your details with the operator.

Dial in: +44 (0) 33 0551 0200

Passcode: Quote M&S Analyst Call when prompted by the operator

Replay: A recording will be available for 48 hours after the call here

2025 Corporate